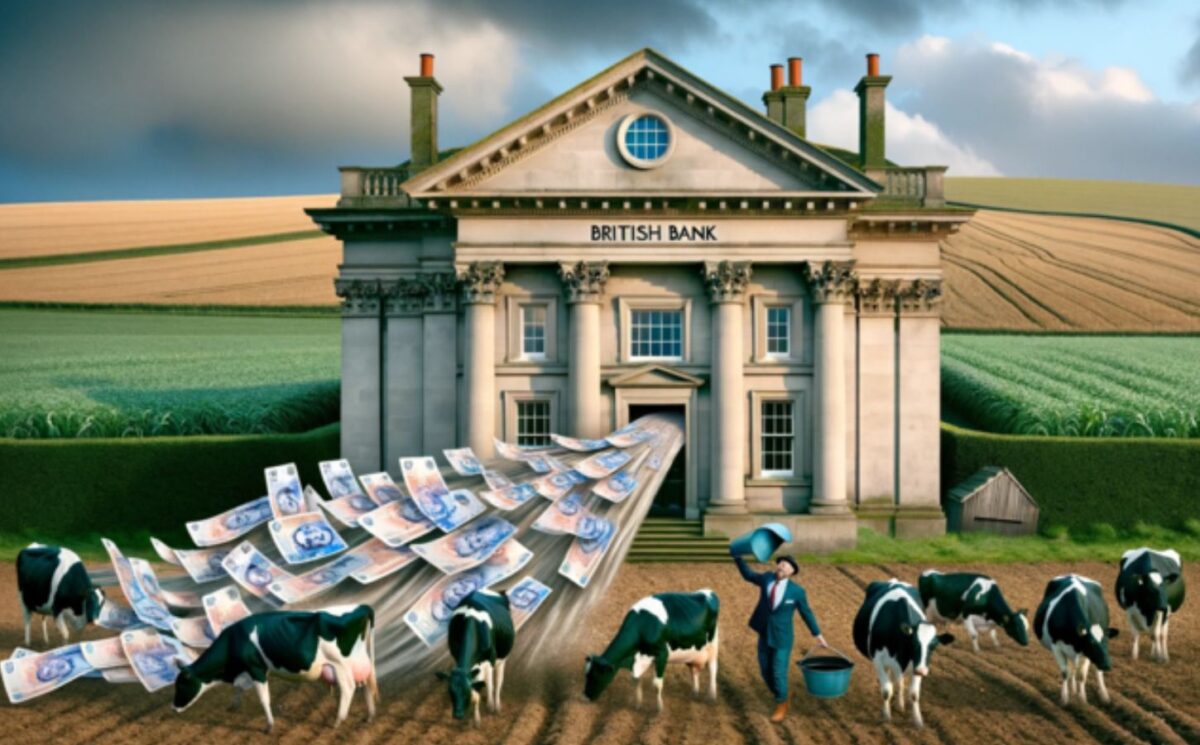

UK banks are providing billions of pounds of financing to big meat and dairy corporations, a new report has revealed.

Titled Bankrolling the Butchers, the report reveals the level of financing that the UK’s six biggest banks are providing to environmentally destructive livestock corporations.

In total, the ‘Big Six’, which includes Barclays and Santander, financed 55 of the world’s largest livestock and animal feed companies to the tune of USD $77 billion between 2015 and 2022, the report calculates.

Martin Bowman, senior policy and campaigns manager at Feedback, the environmental campaign group responsible for the report, told Plant Based News: “UK banks are not taking their commitments on net zero, deforestation, human rights, pandemic risks, pollution, or animal welfare seriously.”

He added: “Any policies which still allow banks to fund destructive corporations like JBS and Cargill are not compatible with a safe future for people and planet.”

The banks funding climate catastrophe

The UK’s ‘Big Six’ banks are Barclays, HSBC, Santander, Lloyds, NatWest, and Standard Chartered.

As well as providing $77 billion of funding, these banks owned nearly $1.2 billion in shareholdings in the 55 livestock companies as of March 2023, the report claims.

Barclays is the largest UK financier of industrial livestock companies. Between 2015 and 2022, it provided $28.2 billion in financing, ahead of HSBC ($23.6 billion) and Santander ($13.7 billion).

“We’re calling on all UK banks to urgently implement action plans to align all agriculture sector financing with the Paris Agreement – and as part of this, to stop all new financing to industrial livestock corporations,” Bowman said.

Animal agriculture holding back climate progress

As COP28 takes place in Dubai, the report is a timely reminder of the harms of big livestock companies.

Five of the worst-offending livestock companies cited are JBS, Marfrig, Cargill, Tyson Foods, and Minerva. Together they received a total of $21.6 billion in finance from the ‘Big Six’ banks between 2015 and 2022.

These five companies combined are responsible for an estimated 595 million tonnes of GHG emissions each year. This is higher than the total emissions of the UK and Ireland.

Agricultural emissions alone will drive the world past 1.5°C of global heating if food systems are not transformed.

Impacts close to home

The report also details how funding animal agriculture is facilitating ecological destruction in the UK.

Through their financing of Cargill, Barclays and HSBC are indirectly contributing to the algal blooms devastating the River Wye. Run-off from intensive poultry farming is one of the leading causes of this ecological damage.

Bowman added: “Industrial livestock corporations are the food system’s biggest cause of emissions, deforestation, human rights abuses, pandemic risks and animal cruelty.

“They are hardwired to mass-produce unsustainable quantities of meat and dairy to preserve the profits of their core business. So defunding these companies is the only sustainable option for banks.”

Calls to break the cycle of climate destruction

The report sets out the case for banks defunding livestock companies. It argues that such defunding is necessary because of the scale of livestock’s environmental impact. It adds that big companies have shown few signs of making meaningful change.

“Banks defend fuelling the fire of the climate crisis by claiming they are engaging with polluters to improve practice – this is delusion, or greenwash, or both” said Bowman.

“Livestock corporations like JBS are openly planning for a 70 percent global increase in animal protein production by 2050 – a recipe for environmental disaster.”

The report points to research showing that even the lowest impact meat and dairy products are more harmful to the environment than the least sustainable plants and cereals.

“UK bank environmental policies are worthless as long as they keep funding these destructive companies, which fiercely lobby against environmental policies and show no sign of being reformable,” Bowman added.

How can banks defund livestock corporations?

Several large financial institutions already have policies of excluding big livestock companies.

One example is De Volksbank, the fourth largest banking group in the Netherlands. The group manages USD $40 billion (€37 billion) in savings. It has signed up to the Partnership for Biodiversity Accounting Financials (PBAF).

The PBAF was formed in 2019 to divert funds away from climate-wrecking companies. Its stated mission is to “contribute to the mainstreaming and harmonization of biodiversity impact in the financial sector.” Similarly, Australian Ethical has a policy of not investing in conventional animal agriculture.